During periods of high market volatility, the natural inclination of investors is to pivot towards asset classes, such as cash, for safety. But there is an alternative course of action, Low Volatility investing, a proven factor-based investing style that investors can utilize during periods of market uncertainty and for achieving their long-term investment objectives.

What is the low volatility anomaly?

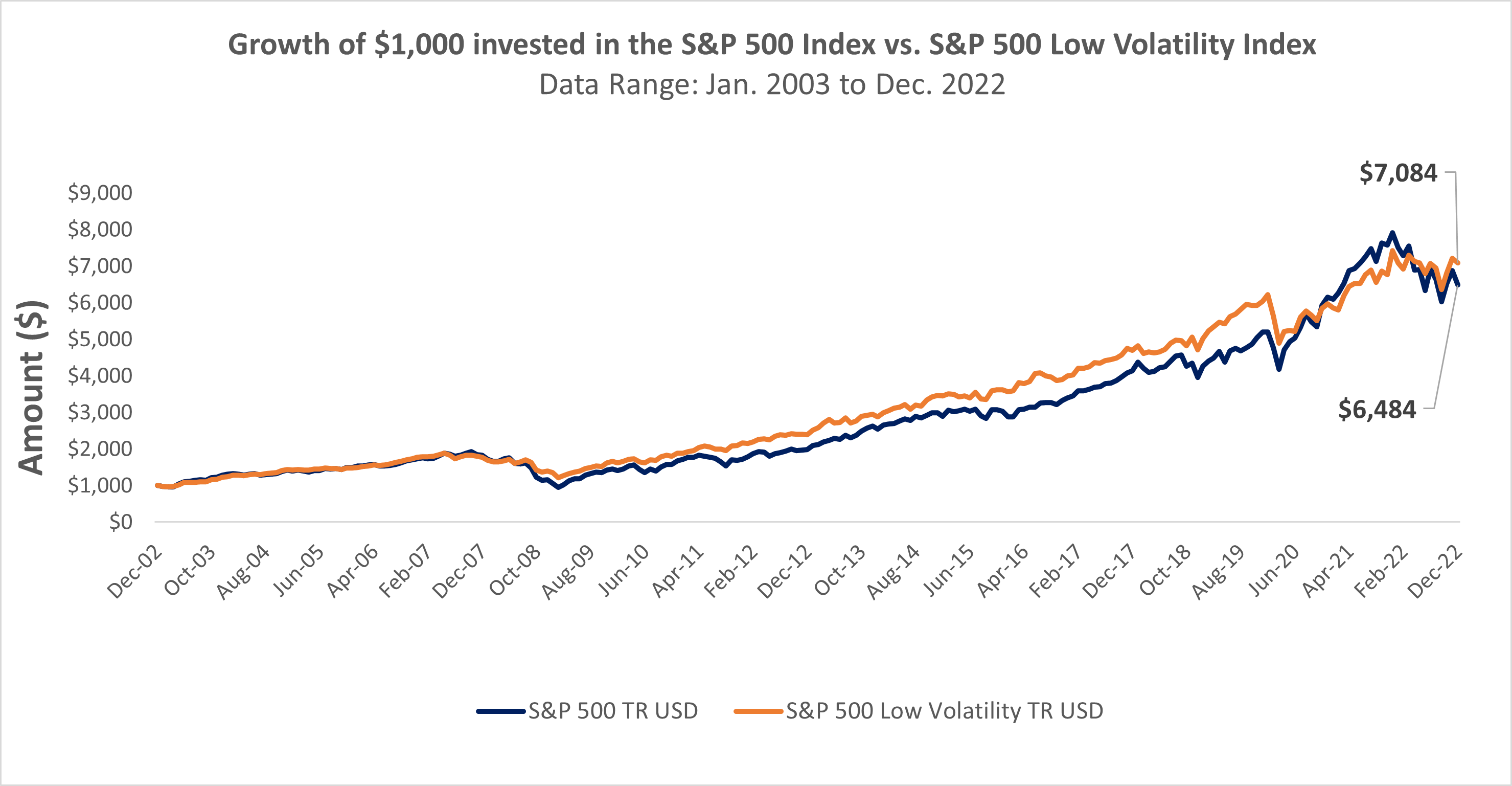

The low volatility anomaly refers to the phenomenon where stocks with lower volatility tend to outperform stocks with higher volatility over the long term. This anomalous behavior is mystifying, as it goes against the central premise of financial markets – taking higher risk, must be compensated with higher return. In viewing the long-term performance of the S&P 500 Low Volatility Index over the past two decades, it has outperformed its parent index, the S&P 500 index.

Understanding the basis for performance

Low volatility portfolios are comprised of stocks that are less volatile than their peers, which means that on a risk-adjusted basis, they should exhibit superior performance and provide exceptional returns relative to other portfolios. Low volatility can be measured in two ways. The first is the standard deviation, which measures the volatility of each stock on a standalone basis, and the second is beta, which measures a stock's volatility and correlation relative to the overall market. The market has a beta of 1.0, so a stock with a beta below one is considered less volatile than the market and vice versa for a stock with a beta above 1.0.

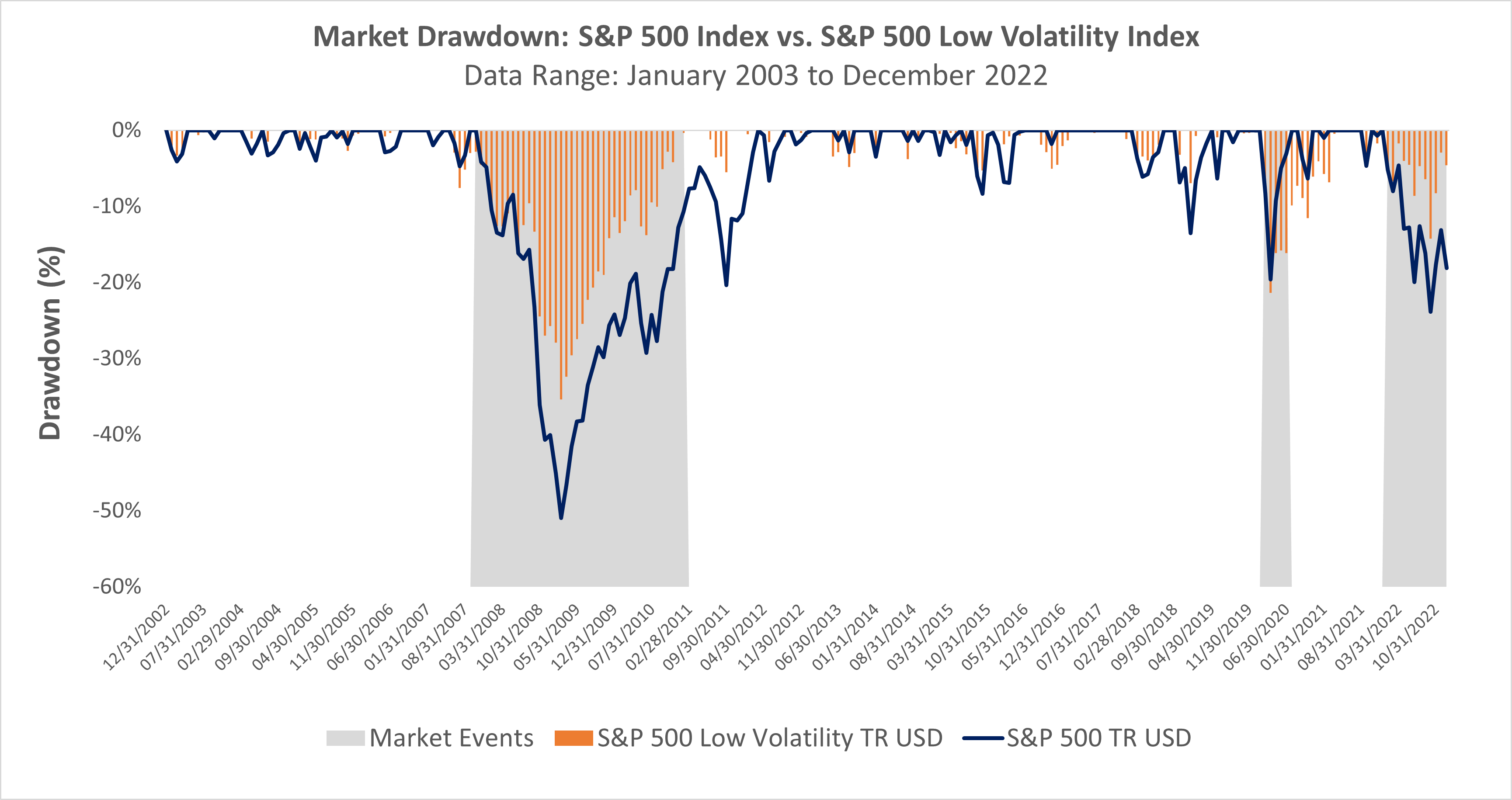

Low volatility portfolios are not impervious to market drawdowns, as over the last two decades, equity markets have faced numerous shocks to the system. When those situations have occurred, low volatility portfolios have generally managed to outperform (i.e. lose less) than the broader market.

Why consider a low volatility portfolio?

Financial markets and the macroeconomic environment are currently in a precarious position. For investors with a low risk tolerance or individuals that believe they can ‘time the market’ – low volatility investing is an approach that they should consider adopting. As observed from the market environment of 2022, all asset classes can be adversely impacted during a market downturn and engaging in ‘market timing’ as a risk management approach does not result in long-term success. Low volatility investing allows investors to benefit from a proven investment strategy that provides them with innate risk-mitigation and a selection of equities best suited to thrive during the ups and downs of an economic cycle.

For investors seeking to access low volatility solutions, Invesco offers a broad suite of low volatility ETFs focusing on different segments of the equity market. Fidelity also has a low volatility ETF, but its focus is purely on the broad US equity market.

- SPLV: Invesco S&P 500 Low Volatility ETF |E/R: 0.25%

- XMLV: Invesco S&P MidCap Low Volatility ETF | E/R: 0.25%

- XSLV: Invesco S&P SmallCap Low Volatility ETF | E/R: 0.25%

- EELV: Invesco S&P Emerging Markets Low Volatility ETF | E/R: 0.29%

- IDLV: Invesco S&P International Developed Low Volatility ETF | E/R: 0.25%

- FDLO: Fidelity Low Volatility Factor ETF | E/R: 0.29%

This content was originally published by our partners at ETF Central