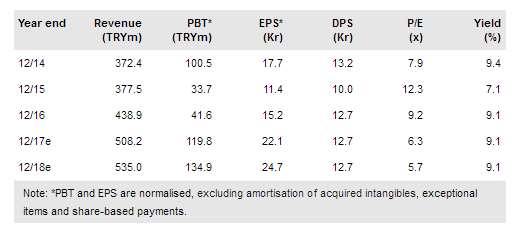

Is Yatirim Ortakligi AS (IS:ISYAT) Q117 results showed a strong performance by the investment banking business, driven by robust equity, debt and derivatives markets, slight increases to some commission margins as well as continued growth in AUM, particularly from higher-fee pension fund assets. Is Investment (the investment bank) posted net profits more than 50% up on Q116, which was the strongest quarter in that year. With the exception of the NPL business, all the consolidated segments beat our expectations and we have revised our estimates upwards as a result. The government’s success in the 16 April referendum may bring greater stability to the turbulent political scene in Turkey, contributing to a better outlook in 2017.

A healthy start to the year

Is Investment reported Q117 revenues 34% ahead year-on-year, including commission revenues up 43%, while interest and trading income advanced 27%. Within commissions, corporate finance and brokerage recorded the strongest growth. This drove a 56% increase in net profit. Among the subsidiary businesses, Efes NPL Asset Management and Is Private Equity continued to record losses but were stable and lower respectively on a sequential basis. The other segments all performed better than expected, particularly Is Asset Management, which saw net profits rise 26% year-on-year. Consolidated net profit more than doubled to TRY27.2m from TRY12.6m in Q116.

To read the entire report Please click on the pdf File Below